The Role of Tax Policy in AI Regulation

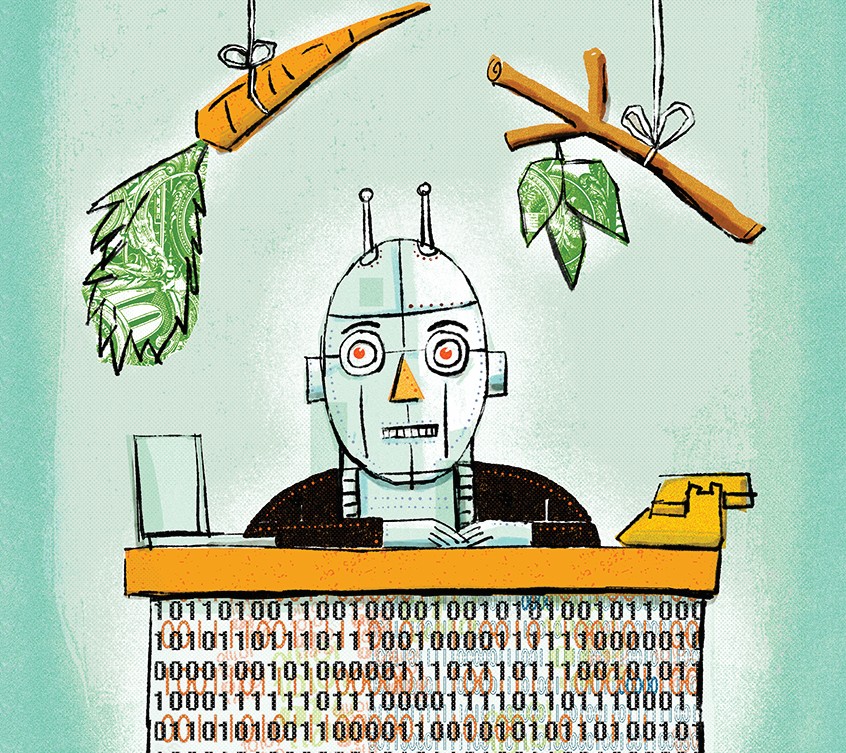

As artificial intelligence (AI) technology evolves, so does the conversation around regulating it. Reuven Avi-Yonah, a prominent professor of law at the University of Michigan, argues that tax policy can serve as an effective tool for managing the impact of AI on society. By implementing strategic tax measures, governments can shape the landscape of AI development and application.

Avi-Yonah highlights the importance of creating a balanced approach to taxation in the tech sector. Such measures can not only generate revenue but also encourage responsible innovation. By taxing companies based on their AI usage and the societal impact of their technologies, lawmakers can incentivize ethical practices and deter harmful applications. This proactive stance could lead to a healthier relationship between technology and society.