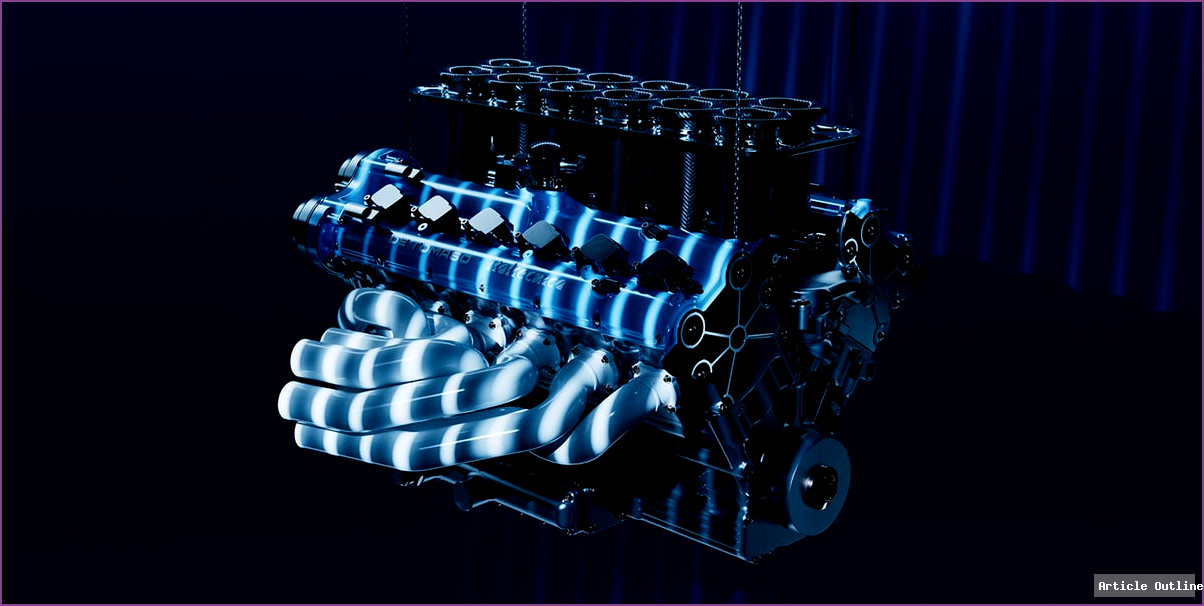

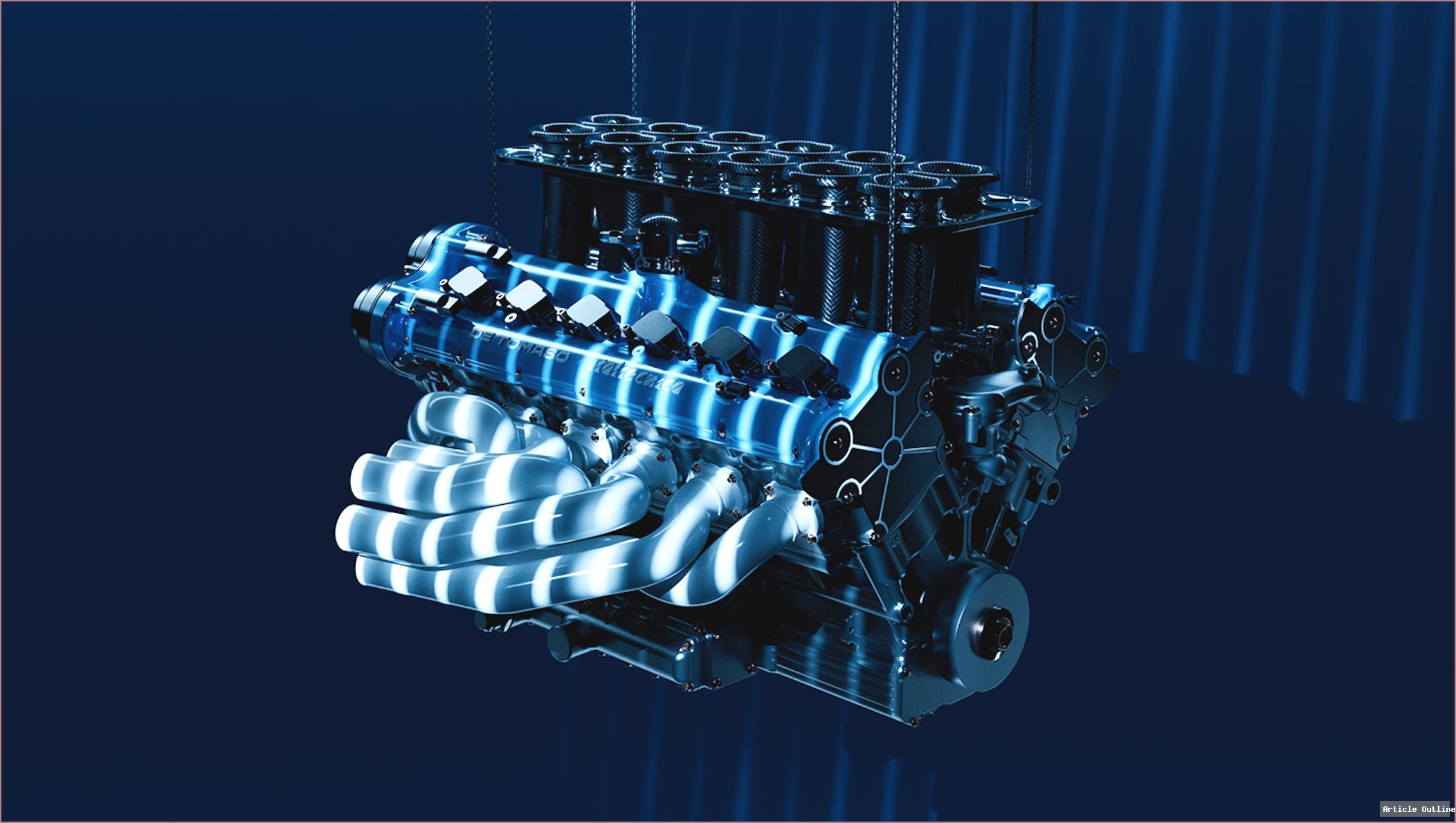

The automotive world just got a seismic jolt: De Tomaso has pulled back the curtain on its jaw-dropping, naturally aspirated 7.0-liter V-12 that will power the upcoming P900 hypercar. In an age where turbochargers, hybrids, and electrification are the norm, this engine is a rare throwback—yet packed with cutting-edge tech. Let’s dig into why this matters for enthusiasts, purists, and the future of supercars.

Why This Matters

- This is one of the last—and most extreme—naturally aspirated V-12s likely to ever see production. With governments and automakers racing toward electrification, De Tomaso’s move is a defiant celebration of analog engineering.

- The P900’s V-12 is an engineering statement that could inspire future low-volume, purist projects—even as mainstream brands retreat from high-revving, multi-cylinder engines.

- This engine is designed for the track, but De Tomaso is hinting at potential road-legal versions. If that happens, it would be an instant collectible—and a living museum piece you can drive.

What Most People Miss

- The V-12’s technical details read like a Formula 1 wish list: 65-degree bank angle, four titanium valves per cylinder, solid billet aluminum crankcase, gear-driven cam system (no belts or chains), and an eight-stage dry sump for oiling during high-g maneuvers.

- It weighs under 400 pounds. For a 900-horsepower, 7.0-liter V-12, that’s astonishing and means the P900’s handling won’t be compromised by a heavy powerplant.

- That 10,200 rpm redline isn’t just for show. Engines that rev this high deliver a unique, spine-tingling soundtrack and throttle response that turbo or hybrid units can’t replicate. Think Ferrari’s F50 or the Gordon Murray T.50, but with even more displacement and drama.

Key Takeaways

- 900 hp, 7.0L, naturally aspirated V-12, 10,200 rpm redline, <400 lbs.

- No electrification, no turbos—just pure mechanical glory.

- The ItalTecnica partnership brings Italian motorsport know-how to the project.

- P900 will debut new visual and aero updates later this year.

Industry Context: The Rarity of the N/A V-12

- Ferrari, Lamborghini, and Aston Martin are all scaling back—or electrifying—their V-12s. The Ferrari 812’s successor will likely be hybridized. Lamborghini’s new Revuelto is a plug-in hybrid.

- De Tomaso’s V-12 is one of the last pure-blooded, naturally aspirated monsters left. Even boutique brands like Pagani have embraced turbocharging or hybrid assistance.

- Compare this with the Mercedes-AMG One, which uses a turbocharged F1-based V6 hybrid, or the Aston Martin Valkyrie (Cosworth V-12, but with hybrid support).

Pros & Cons Analysis

- Pros:

- Unfiltered, high-revving sound and response

- Ultra-lightweight for its output

- Collectible status guaranteed

- Track-focused engineering purity

- Cons:

- Likely extreme cost and rarity

- Track-only (for now), so very limited access

- Potentially short window before regulations shut down such engines for good

Expert Commentary

“In an era where computers and batteries dominate, De Tomaso’s V-12 is a reminder of why we fell in love with cars in the first place: emotion, sound, and mechanical artistry.”

For collectors and speed fanatics, this isn’t just a car—it’s a last call for the golden age of internal combustion. If you hear one scream down the track, savor the moment. You may never hear its like again.

The Bottom Line

De Tomaso’s new V-12 is more than an engine. It’s a protest song—loud, unapologetic, and brilliant. For those who believe in the soul of driving, it’s a beacon in a world going increasingly silent. Here’s hoping this monster of a motor makes it to the road, not just the racetrack.